Menu

About Moving Averages

We recently discussed Ichimoku Kinkō Hyō and have had some positive feedback. We will come back to it in more depth soon, but first a piece on Moving Averages!

A Moving Average (MA) can be defined as an indicator that shows the average value of a currency's price over a set period. They can be used to measure momentum and potentially define areas of possible support and resistance. They are known as lagging indicators because they confirm a trend rather than predict a trend.

Their importance is increased for technical analysts because they form the basis for other technical indicators and overlays, such as MACD and Bollinger Bands.

The two most popular MAs are:

Simple Moving Average (SMA) - e.g. a 5 day SMA = the sum of 5 day

closing prices divided by 5.

Exponential Moving Average (EMA) - reduces

the lag by applying more weight to recent prices.

In this note I will concentrate on Simple

Moving Averages.

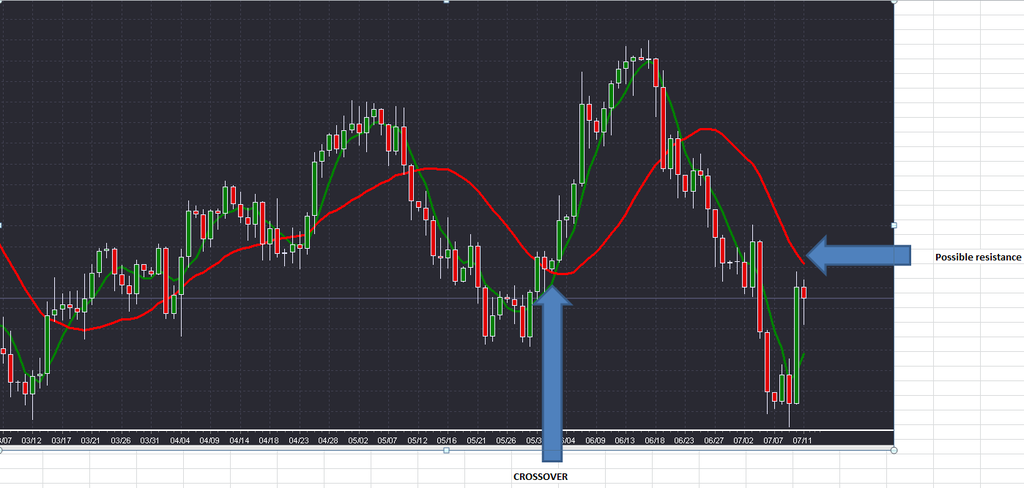

The graph below comes from LION Trader and

I have created a daily chart of GBPUSD.

I have built two moving averages visualised by the Green and Red lines.

Green = 5 period Simple Moving Average

Red

= 20 period Simple Moving Average

Like all things, nothing is as simple as it

first appears....although the reason I like moving averages is that they are simple! You can then add other bits to them (like a

cake) to make them more fancy if you want.

A possible trading scenario could go

something like:

When the shorter MA (green) crosses the

longer MA (red) upwards then buy (you are assuming that the price is trending

upwards).

When the shorter MA (green) crosses the

longer MA (red) downwards then sell (you are assuming that the price is

trending lower).

If you believe you have a trend then

placing a trailing stop can be very powerful.

However you can potentially use the next crossover a s a way to close

and reverse your position. This means

you will always have exposure to the market you are trading.

The times that MAs do not work particularly

well is when the market does not know where it is going, staying in a tight

trading range or in volatile situations.

Happy trading!

The Hirose Team

My Hirose Login

My Hirose Login